Markets are much more complex than we think

Rate hikes sound scary for stocks and crypto, but when you actually look at the data it gives us hope that we might survive.

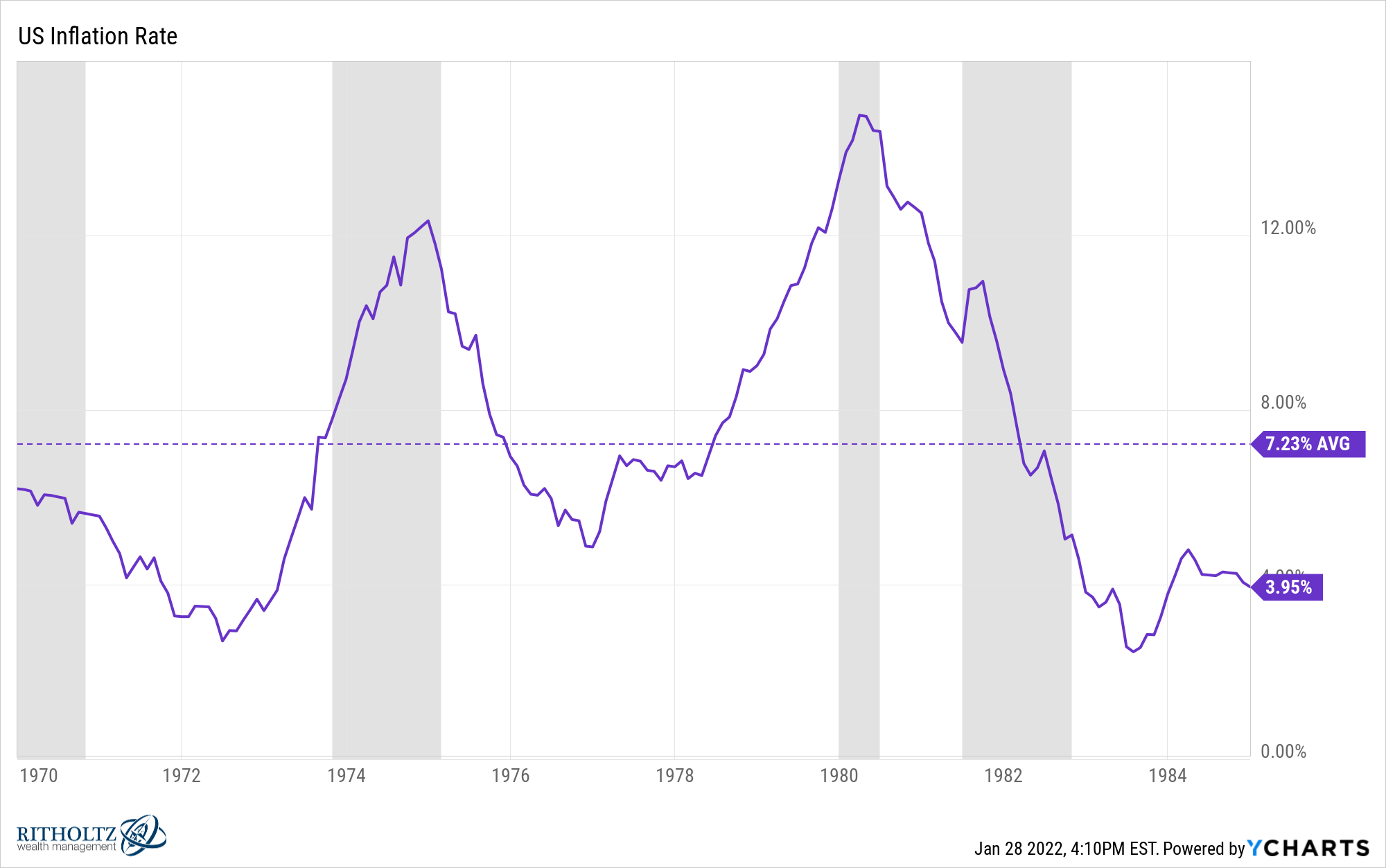

It feels like everyone paying attention to markets is worried about inflation and interest rates. Higher rates would certainly set a strong headwind for stocks, real estate, cryptocurrency, and basically most investments.

What's worth remembering, though, is that there are thousands of factors at play in markets. Inflation and rates are certainly two big ones, but when we look to history we can see that there's clearly more going on.

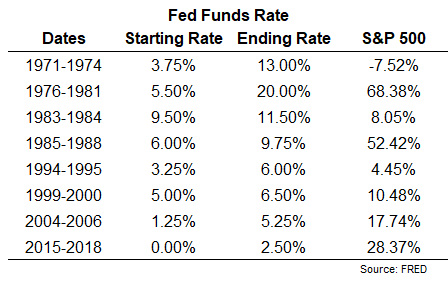

In "How Do Stocks Perform When the Fed Raises Rates?" Ben Carlson does the obvious and actually looks at how stocks performed historically under different Fed rate regimes. The answer might surprise a good Finance 101 student!

I love Ben's disclaimer that "this data requires a dump truck of salt." Don't just take the average return of 23% and shout from the rooftop too quickly that rate hikes are good for stocks! You have to consider the context.

Stocks crashed almost 50% in 1973-74.

The market surged into 1981 but fell 27% in a brutal bear market that extended into 1982 (which included the aforementioned recession induced by the Fed).

The 1985-1988 period includes the biggest one day crash of all-time in October 1987, which saw the market fall 34% in a week.

And it goes on...

Fed rate changes are endogenous, they depend on the proximate context for the market. Did the Fed hike rates because the economy and inflation were overheating? Markets are forward looking and in many instances tend to sell off before the Fed takes action, which is exactly what has happened this last month, or three in the case of crypto.

Higher expected returns make sense after a sell off, and maybe markets like a responsible central bank that tackles inflation. Who knows? There's so much going on, this is just a reminder not to let the stories we tell ourselves be taken too seriously. Rate hikes do sound scary for stocks and crypto, but when you actually look at the data it gives us hope that we might survive.

Comments

Sign in or become a Finpunk by Rob Viglione member to join the conversation.